India: AgFunder and Omnivore have released the sixth India AgriFoodTech Investment Report, detailing just under US$1 billion in startup investment, a 60 per cent year-over-year decline from US$2.4 billion in 2022. However, India maintained a steady deal activity with 129 deals, only slightly fewer than in 2022. This reduction aligns closely with the global decline in agrifoodtech investments, which fell by 50 per cent year-over-year.

Unlike the global market, however, the total funds raised by Indian agrifood startups were not far off from the US$1.3 billion garnered in pre-Covid 2019, suggesting a normalisation of market conditions after a period of excessive valuations. A concerning trend is the limited participation of agrifood investors, with Omnivore being one of the few remaining, alongside generalist and climate-focused VCs. This scenario underscores the need for more committed investors across all stages.

Key highlights of the report

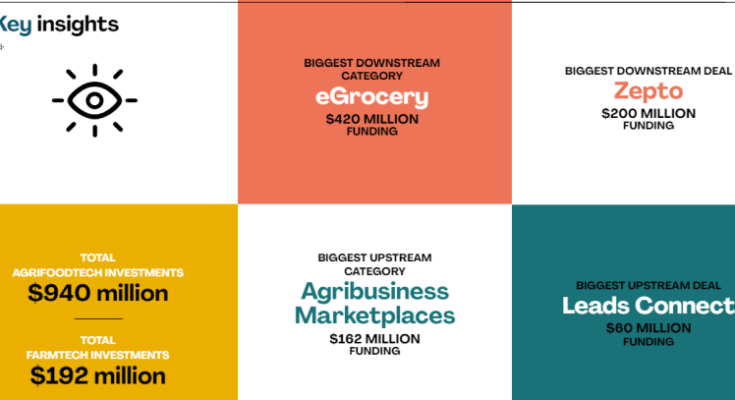

- In 2023, Indian agrifoodtech startups raised US$940 million across 129 deals, down 60 per cent from 2022.

- The number of deals remained almost flat with 129 closing in 2023 compared to 133 deals in 2022, indicating smaller deal sizes given the steep decline in dollars raised.

- More early-stage deals closed in 2023 than 2022 indicating continued interest by investors in the category but at much lower valuations than in previous years.

- The median deal sizes dropped significantly year-on-year across stages and most dramatically at the late stages: 50 per cent at the early stages (Seed and Series A), 39 per cent at the growth stages (Series B and C) and 89 per cent at Series D and later.

Both AgFunder and Omnivore continue to explore deals that push beyond traditional agrifood boundaries into adjacent sectors, highlighting the growing interconnectedness of food, agriculture, and other industries like climate-tech. Despite a decrease in the median deal sizes, the willingness to invest persists, although at lower ticket sizes, with Ag Marketplaces and eGrocery receiving the most attention yet again. However, there are fewer players in the market than before, reflecting Power Law dynamics.

Other insights in the report

- All parts of the supply chain received substantially less funding in 2023 than 2022, with Midstream startups faring the worst with an 80 per cent decrease.

- eGrocery was still the most funded category, albeit with a 46 per cent year-over-year drop to US$420 million.

- Agribusiness Marketplaces & Fintech was the second-best funded category, raising US$162 million, a more pronounced 62 per cent decline.

- Together, eGrocery and Ag Marketplaces & Fintech accounted for 62 per cent of the capital raised in 2023.

- Many later-stage startups raised follow-on bridge capital in 2023, resulting in smaller deals at the late stage. This is in line with global trends of agrifoodtech investments where later-stage startups have raised down rounds and overall valuations have been severely corrected.

Louisa Burwood-Taylor, Managing Editor of AgFunder News, observed, “The global downturn in agrifoodtech investments is attributed to fewer and smaller deals, but the situation in India indicates a fundamental shift. Although the number of deals remains nearly unchanged, the investment approach in India has become more selective and merit-based, suggesting a gradual and promising revival of the sector.”

Mark Kahn, Managing Partner, Omnivore, said, “What we see unfolding before us is the return of realistic valuations that reflect the operational and financial achievements of the companies. From unbridled growth strategies, the focus is squarely on prioritising building a strong business model, focusing on profitability, and creating value for customers and stakeholders. Like 2023, this year will be a great vintage year to invest in promising startups, especially for founders who are building differentiated and unit economically viable businesses from the beginning.”

This report is produced by AgFunder in partnership with Omnivore, includes spotlights on the startups – altM, Fasal, Faunatech, and Intello Labs.